To issue shares under an EMI scheme a company must have fewer than 250 full time equivalent employees. This number is taken as a ‘snapshot’ at the time the options are issued and so if the employee numbers subsequently exceed 250 then existing EMI options are unaffected.

The number of employees includes those employed by subsidiaries and any overseas employees.

We are frequently asked about the impact of employees on zero hours contracts and whether they should be counted when determining whether the company has fewer than 250 employees.

The average working time of the zero hours employees should be included in the calculation of FTE employees. As such, a calculation for a company with full time, part time and zero hours contract employees might be as follows:

180 full time employees working 37.5 hours per week = 6,750 hours

40 part time employees working 20 hours per week = 800 hours

Average hours per week worked by employees on zero hours contracts = 200 hours

Total hours worked per week = 7,750

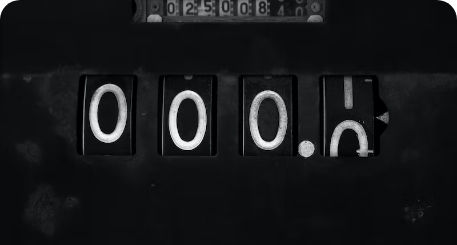

7,750 / 37.5 = 207 full time equivalent roles. The company meets the employee numbers requirement to grant EMI share options.